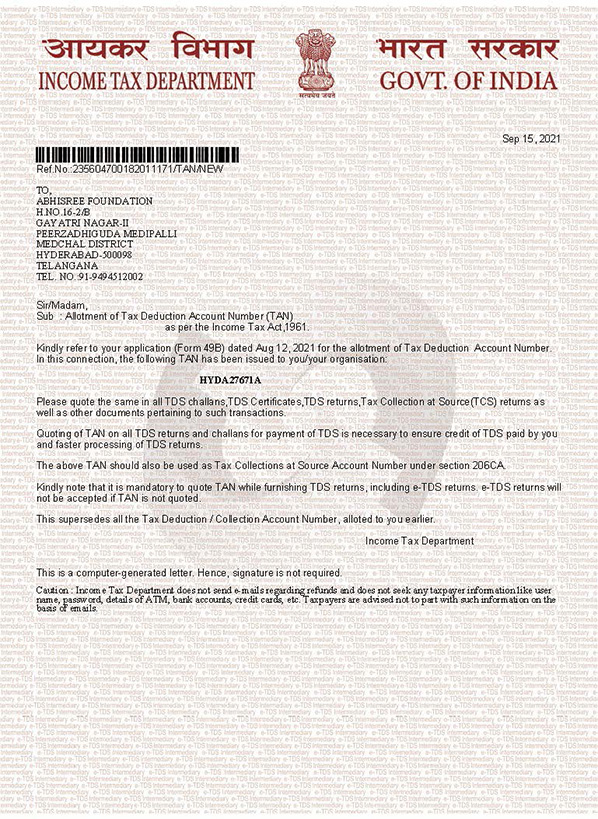

| Name of the Organization | ABHISREE FOUNDATION |

| Address | 18-1/43/2, 1st Floor, Main Road, Balaji Nagar, Peerzadiguda, Mdl.Medipally, Medchal-Malkajgiri Dist. Telangana – 500098. |

| Contact Details | Phone: +91 80089 62108 |

| abhisreefoundation@gmail.com | |

| Website | www.abhisreefoundation.org |

| Name of Chief Functionary | Avula Venkatesh |

| Designation | Director |

| Registration No. | 308 of 2020 |

| Registration Act | Telangana Societies Registration Act, 2001 |

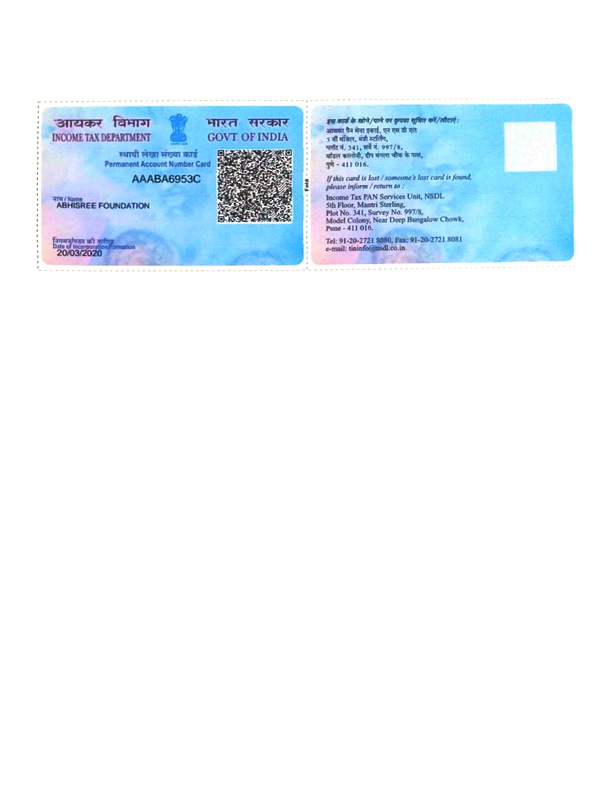

| Permanent Account Number (PAN) | AAABA6953C |

| IT Exemptions |

80 G: AAABA6953CF20212 12 A: AAABA6953CE20214 |

| DARPAN ID | TS/2020/0260778 |

| CSR NO. | SRN-T35474196 |

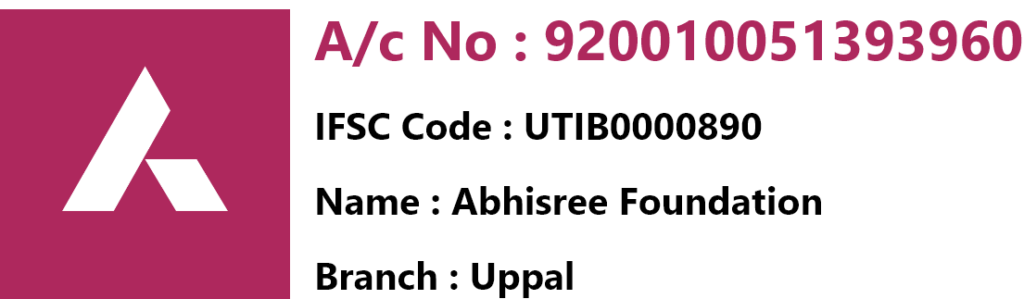

| Bank Account |

|

FORM NO. 10AC

(See rule 17A/11AA/2C) Order for provisional registration

| 1 | PAN | AAABA6953C |

| 2 | Name | ABHISREE FOUNDATION |

| 2a | Address | |

| Flat/Door/Building | 16-2/8 | |

| Name of premises/Building/Village | MEDIPALLY | |

| Road/Street/Post Office | Medipalli S.O | |

| Area/Locality | Ghatkesar | |

| Town/City/District | K.V.RANGAREDDY | |

| State | Telangana | |

| Country | INDIA | |

| Pin Code/Zip Code | 500098 | |

| 3 | Document Identification Number | AAABA6953CE2021401 |

| 4 | Application Number | 236595360040821 |

| 5 | Unique Registration Number | AAABA6953CE20214 |

| 6 | Section/sub-section/clause/sub-clause/proviso in which provisional registration is being granted | 02-Sub clause (vi) of clause (ac) of sub-section (1) of section 12A |

| 7 | Date of provisional registration | 23-09-2021 |

| 8 | Assessment year or years for which the trust or institution is provisionally registered | From AY 2022-23 to AY 2024-25 |

| 9 | Order for provisional registration: | |

| a. After considering the application of the applicant and the material available on record, the applicant is hereby granted provisional registration with effect from the assessment year mentioned at serial no 8 above subject to the conditions mentioned in row number 10. | ||

| b. The taxability, or otherwise, of the income of the applicant would be separately considered as per the provisions of the Income Tax Act, 1961. | ||

| c. This order is liable to be withdrawn by the prescribed authority if it is subsequently found that the activities of the applicant are not genuine or if they are not carried out in accordance with all or any of the conditions subject to which it is granted, if it is found that the applicant has obtained the provisional registration by fraud or misrepresentation of facts or it is found that the assessee has violated any condition prescribed in the Income Tax Act, 1961. | ||

| 10 | Conditions subject to which provisional registration is being granted | |

| The provisional registration is granted subject to the following conditions:- | ||

| a. As and when there is a move to amend or alter the objects/rules and regulations of the applicant, prior approval of the Commissioner of Income Tax shall be sought along with the draft of the amended deed and no such amendment shall be effected until and unless the approval is accorded. | ||

| b. In the event of dissolution, surplus and assets shall be given to an organization, which has similar objects and no part of the same will go directly or indirectly to anybody specified in section 13(3) of the Income Tax Act, 1961. | |

| c. In case the trust/institution is converted into any form, merged into any other entity or dissolved in any previous year in terms of provisions of section 115TD, the applicant shall be liable to pay tax and interest in respect of accreted income within specified time as per provisions of section 115TD to 115TF of the Income Tax Act, 1961 unless the application for fresh registration under section 12AB for the said previous year is granted by the Commissioner. | |

| d. The Trust/ Institution should quote the PAN in all its communications with the Department. | |

| e. The registration u/s 12AB of the Income Tax Act, 1961 does not automatically confer any right on the donors to claim deduction u/s 80G. | |

| f. Order u/s 12AB read with section 12A does not confer any right of exemption upon the applicant u/s 11 and 12 of Income Tax Act, 1961. Such exemption from taxation will be available only after the Assessing Officer is satisfied about the genuineness of the activities promised or claimed to be carried on in each Financial Year relevant to the Assessment Year and all the provisions of law acted upon. This will be further subject to provisions of section 2(15) of the Income Tax Act, 1961. | |

| g. No change in terms of Trust Deed/ Memorandum of Association shall be effected without due procedure of law and its intimation shall be given immediately to Office of the Jurisdictional Commissioner of Income Tax. The registering authority reserves the right to consider whether any such alteration in objects would be consistent with the definition of “charitable purpose” under the Act and in conformity with the requirement of continuity of registration. | |

| h. The Trust/ Society/ Non Profit Company shall maintain accounts regularly and shall get these accounts audited in accordance with the provisions of the section 12A(1)(b) of the Income Tax Act, 1961. Seperate accounts in respect of each activity as specified in Trust Deed/ Memorandum of Association shall be maintained. A copy of such account shall be submitted to the Assessing Officer. A public notice of the activities carried on/ to be carried on and the target group(s) (intented beneficiaries) shall be duly displayed at the Registered/ Designated Office of the Organisation. | |

| i. The Trust/ Institution shall furnish a return of income every year within the time limit prescribed under the Income Tax Act, 1961. | |

| j. Seperate accounts in respect of profits and gains of business incidental to attainment of objects shall be maintained in compliance to section 11(4A) of Income Tax Act, 1961. | |

| k. The registered office or the principal place of activity of the applicant should not be transferred outside the jurisdiction of Jurisdictional Commissioner of Income Tax except with the prior approval. | |

| l. No asset shall be transferred without the knowledge of Jurisdictional Commissioner of Income Tax to anyone, including to any Trust/ Society/ Non Profit Company etc. | |

| m. The registration so granted is liable to be cancelled at any point of time if the registering authority is satisfied that activities of the Trust/ Institution/ Non Profit Company are not genuine or are not being carried out in accordance with the objects of the Trust/ Institution/ Non Profit Company. | |

| n. If it is found later on that the registration has been obtained fraudulently by misrepresentation or suppression of any fact, the registration so granted is liable to be cancelled as per the provision u/s section 12AB(4) of the Act. | |

| o. This certificate cannot be used as a basis for claiming non-deduction of tax at source in respect of investments etc. relating to the Trust/ Institution. |

| p. All the Public Money so received including for Corpus or any contribution shall be routed through a Bank Account whose number shall be communicated to Office of the Jurisdictional Commissioner of Income Tax. | ||

| q. The applicant shall comply with the provisions of the Income Tax Act, 1961 read with the Income Tax Rules, 1962. | ||

| r. The registration and the Unique registration number has been instantly granted and if, at any point of time, it is noticed that form for registration has not been duly filled in by not providing, fully or partly, or by providing false or incorrect information or documents required to be provided under sub-rule (1) or (2) of rule 17A or by not complying with the requirements of sub- rule (3) or (4) of the said rule, the registration and Unique Registration Number (URN), shall be cancelled and the registration and URN shall be deemed to have never been granted or issued. | ||

| Name and Designation of the Registration Granting Authority |

Principal Commissioner of Income Tax/ Commissioner of Income Tax (Digitally signed) |

|

Certification signature by SIBICHEN K MATHEW

<k.sibichen.mathew@incometax.gov.in>, Validity Unknown

Digitally signed by SIBICHEN K MATHEW Date: 2021.09.23

22:55:38 IST

FORM NO. 10AC

(See rule 17A/11AA/2C) Order for provisional approval

| 1 | PAN | AAABA6953C |

| 2 | Name | ABHISREE FOUNDATION |

| 2a | Address | |

| Flat/Door/Building | 16-2/8 | |

| Name of premises/Building/Village | MEDIPALLY | |

| Road/Street/Post Office | Medipalli S.O | |

| Area/Locality | Ghatkesar | |

| Town/City/District | K.V.RANGAREDDY | |

| State | Telangana | |

| Country | INDIA | |

| Pin Code/Zip Code | 500098 | |

| 3 | Document Identification Number | AAABA6953CF2021201 |

| 4 | Application Number | 236742860040821 |

| 5 | Unique Registration Number | AAABA6953CF20212 |

| 6 | Section/sub-section/clause/sub-clause/proviso in which provisional approval is being granted | 12-Clause (iv) of first proviso to sub-section (5) of section 80G |

| 7 | Date of provisional approval | 23-09-2021 |

| 8 | Assessment year or years for which the trust or institution is provisionally approved | From 23-09-2021 to AY 2024-25 |

| 9 | Order for provisional approval: | |

| a. After considering the application of the applicant and the material available on record, the applicant is hereby granted provisional approval with effect from the assessment year mentioned at serial no 8 above subject to the conditions mentioned in row number 10. | ||

| b. The taxability, or otherwise, of the income of the applicant would be separately considered as per the provisions of the Income Tax Act, 1961. | ||

| c. This order is liable to be withdrawn by the prescribed authority if it is subsequently found that the activities of the applicant are not genuine or if they are not carried out in accordance with all or any of the conditions subject to which it is granted, if it is found that the applicant has obtained the provisional approval by fraud or misrepresentation of facts or it is found that the assessee has violated any condition prescribed in the Income Tax Act, 1961. | ||

| 10 | Conditions subject to which provisional approval is being granted | |

| The provisional approval is granted subject to the following conditions:- | ||

| a. No change in the deed of the applicant trust/society/non profit company or any of its bye-laws shall be affected without the due procedure of law and the approval of the Competent Authority as per provisions of law and its intimation shall be given immediately to Office of the Jurisdictional Commissioner of Income Tax and to the Assessing Officer. | ||

| b. Any change in the trustees or address of the applicant trust/society/non-profit company shall be intimated forthwith to Office of the Jurisdictional Commissioner of Income Tax and to the Assessing Officer. | ||

| c. The applicant trust/society/non profit company shall maintain its accounts regularly and also get them audited as per the provisions of section 80G(5)(iv) read with section 12A(1)(b)/10(23C) of the Income Tax Act,1961. | ||

| d. Certificate of donation shall be issued to the donor in form no 10BE, as per the provisions of rule 18AB. | ||

| e. No cess or fee or any other consideration shall be received in violation of section 2(15) of the Income Tax Act, 1961. | ||

| f. The trust/society/non profit company shall file the return of income of its trust/society/non profit company as per the provisions of section 139(1)/(4A)/(4C) of the Income Tax Act, 1961. | ||

| g. The approval granted through this order shall apply to the donations received only if the applicant trust/society/non profit company, established in India for charitable purpose, fulfills the conditions laid down in section 80G(5) of the Income Tax Act, 1961 and the religious expenditure does not exceed the limit specified in section 80G(5B) of the said Act. | ||

| h. If the applicant trust/ society/ non-profit company derives any income, being profits and gains of business, it shall maintain separate books of account in respect of such business as provided in section 80G(5)(i) of the Income Tax Act,1961. Further, any donation received by the applicant shall not be used, directly or indirectly, for the purposes of such business and a certificate shall be issued to every person making a donation to the effect that the applicant maintains separate books of account in respect of the business and the donation received by it will not be used, directly or indirectly, for the purpose of the business. | ||

| i. The applicant shall comply with the provisions of the Income Tax Act, 1961 read with the Income Tax Rules, 1962. | ||

| j. The approval and the Unique registration number has been instantly granted and if, at any point of time, it is noticed that form for approval has not been duly filled in by not providing, fully or partly, or by providing false or incorrect information or documents required to be provided under sub-rule (1) or (2) of rule 11AA or by not complying with the requirements of sub- rule (3) or (4) of the said rule, the approval and Unique Registration Number (URN), shall be cancelled and the approval and URN shall be deemed to have never been issued or granted. | ||

| Name and Designation of the Approving Authority |

Principal Commissioner of Income Tax/ Commissioner of Income Tax (Digitally signed) |

|

Certification signature by SIBICHEN K MATHEW

<k.sibichen.mathew@incometax.gov.in>, Validity Unknown

Digitally signed by SIBICHEN K MATHEW Date: 2021.09.23

22:53:00 IST

GOVERNMENT OF INDIA MINISTRY OF CORPORATE AFFAIRS

GOVERNMENT OF INDIA MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES

Dated : 13-08-2021

NOTE – THIS LETTER IS ONLY AN APPROVAL FOR REGISTRATION OF THE ENTITIES FOR UNDERTAKING CSR ACTIVITIES.

To,

ABHISREE FOUNDATION , H.NO.16-2/8,GAYATRI NAGAR II,PEERZADHIGUDA,MEDIPALLI,HYDERABAD,TG02,TG,500098

PAN : AAABA6953C

Subject: In Reference to Registration of Entities for undertaking CSR activities

Reference: Your application dated 13-08-2021 (SRN-T35474196)

Sir/Madam,

With reference to the above, it is informed that the entity has been registered for undertaking CSR activities and the Registration number is CSR00013134. Please refer the registration number for any further communication.

Registrar of Companies

ROC-DELHI

Note: The corresponding form has been approved and this letter has been digitally signed through a system generated digital signature.

ABHISREE FOUNDATION

|

Unique Id of VO/NGO TS/2020/0260778 |

|

DARPAN Reg. Date 29-06-2021 |

Registration Details

|

Registered With |

Registrar of Societies |

|

Type of NGO |

Registered Societies (Non-Government) |

|

Registration No |

308 of 2020 |

|

Copy of Registration Certificate |

Available |

|

Copy of Pan Card |

Available |

|

Act name |

Telangana Societies Registration Act., 2001 |

|

City of Registration |

Hyderabad |

|

State of Registration |

TELANGANA |

|

Date of Registration (Society / Trust / Entity) |

20-03-2020 |

Members

|

Name |

Designation |

Pan |

Aadhaar |

|

AAVULA VENKATESH |

President |

Available |

Available |

|

PITTALA MALLESH |

Secretary |

Available |

Available |

|

PITTALA SUKANYA |

Joint Secretary |

Available |

Available |

Sector/ Key Issues

Key Issues Agriculture,Dalit Upliftment,Differently Abled,Drinking Water,Education & Literacy,Environment & Forests,Rural Development & Poverty Alleviation,Vocational Training,Women’s Development & Empowerment,Youth Affairs,Any Other,Skill Development,Children,Art & Culture,Biotechnology,Civic Issues,Disaster Management,Aged/Elderly,Food Processing,Health & Family Welfare,HIV/AIDS,Housing,Human Rights,Information & Communication Technology,Legal Awareness & Aid,Micro Finance (SHGs),Panchayati Raj,Right to Information & Advocacy,Science & Technology,Tourism,Water Resources

|

Operational TELANGANA Area- States |

|

Operational TELANGANA->Hyderabad Area- District |

FCRA details

|

FCRA Available FCRA Registration no. |

|

Not Available Not Available |

Details of Achievements

skill development programme , covid 19 relief activities etc

Source of Funds

|

Department Name |

Source |

Finacial Year |

Amount Sanctioned |

Purpose |

|

Not Specified |

Any Other |

2020-2021 |

Not Specified |

LOCAL |

|

|

|

|

|

DONATIONS |

|

|

|

|

|

COLLECTED |

|

|

|

|

|

FOR COVID |

|

|

|

|

|

RELIEF AND |

|

|

|

|

|

SKILL |

|

|

|

|

|

DEVELOPMENT |

|

|

|

|

|

PROG ETC., |

|

Not Specified |

Any Other |

2019-2020 |

Not Specified |

REGISTERED ON 20/03/2020 ONLY |

|

Not Specified |

Any Other |

2021-2022 |

Not Specified |

LOCAL |

|

|

|

|

|

DONATIONS |

|

|

|

|

|

FOR |

|

|

|

|

|

CHARITABLE |

|

|

|

|

|

ACTIVITIES |

Contact Details

|

Address H.No. 162/8/ Gayathri NagarII/Peerzadiguda/Medipally/Medchal District/Hyderabad/Telangana/India500098. |

|

City Hyderabad |

|

State |

TELANGANA |

|

Telephone |

Not Available |

|

Mobile No |

8008962108 |

|

Website Url |

Not Available |

|

|

ABHISREEFOUNDATION(at)GMAIL[dot]COM |

|

Last modified on |

20-07-2020 |